Cutting Edge Database Monitoring Technology

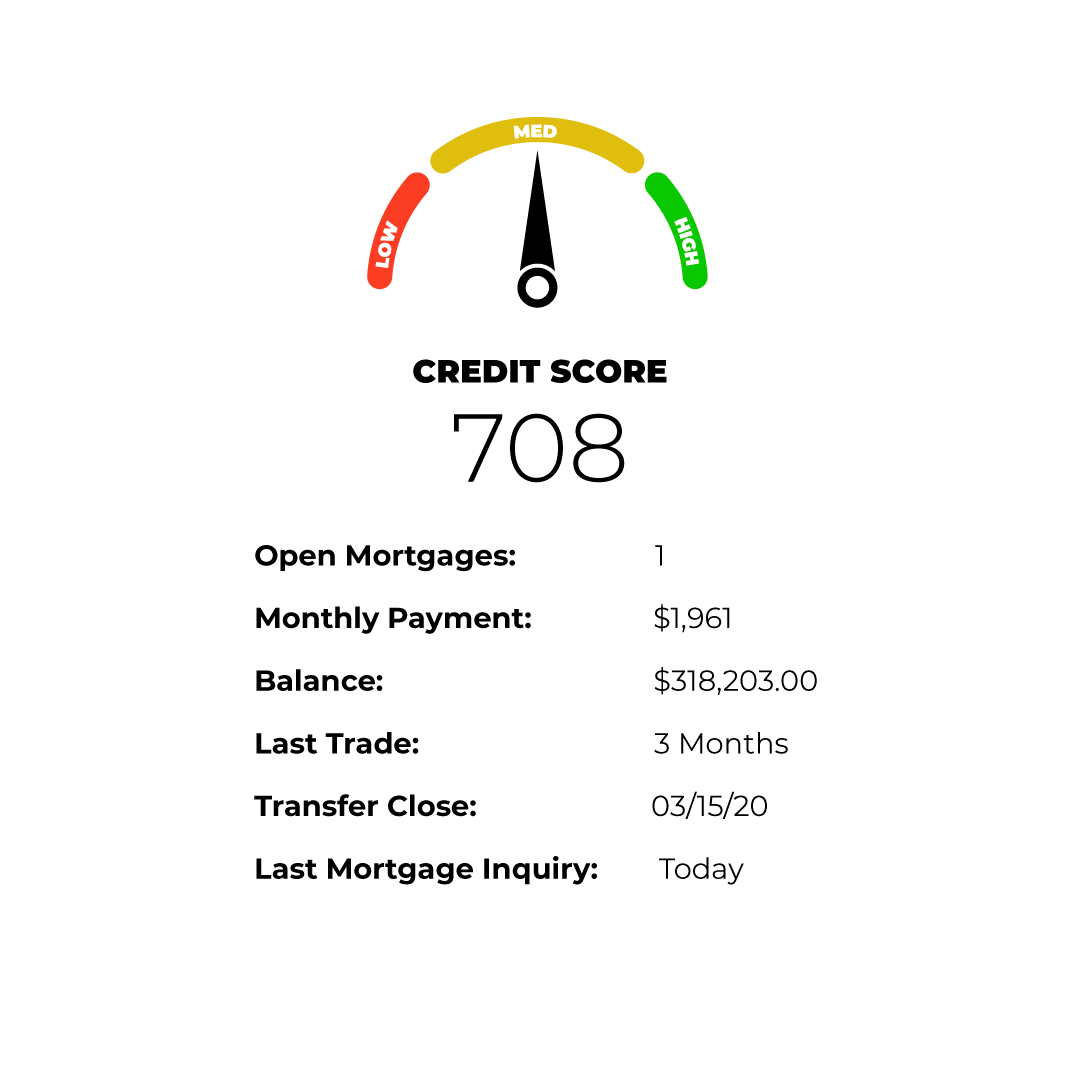

Our technology constantly scans your database of customers, contacts, leads, realtor databases or past clients. We notify you when any of those contacts are ready for a mortgage transaction. We notify you of anyone who: just applied for a mortgage, improved their credit, listed their home for sale, or hundreds of other proven data points that predict the most likely homebuyers.